If you want to get the most out of your financial solutions by Sddfcu, there are a few things you should know. These tips and tricks can help you find the best strategies to fit your needs and make sure they are implemented successfully.

Sddfcu is a credit union that offers many different financial solutions to members. These include checking and savings accounts, loans, and credit cards.

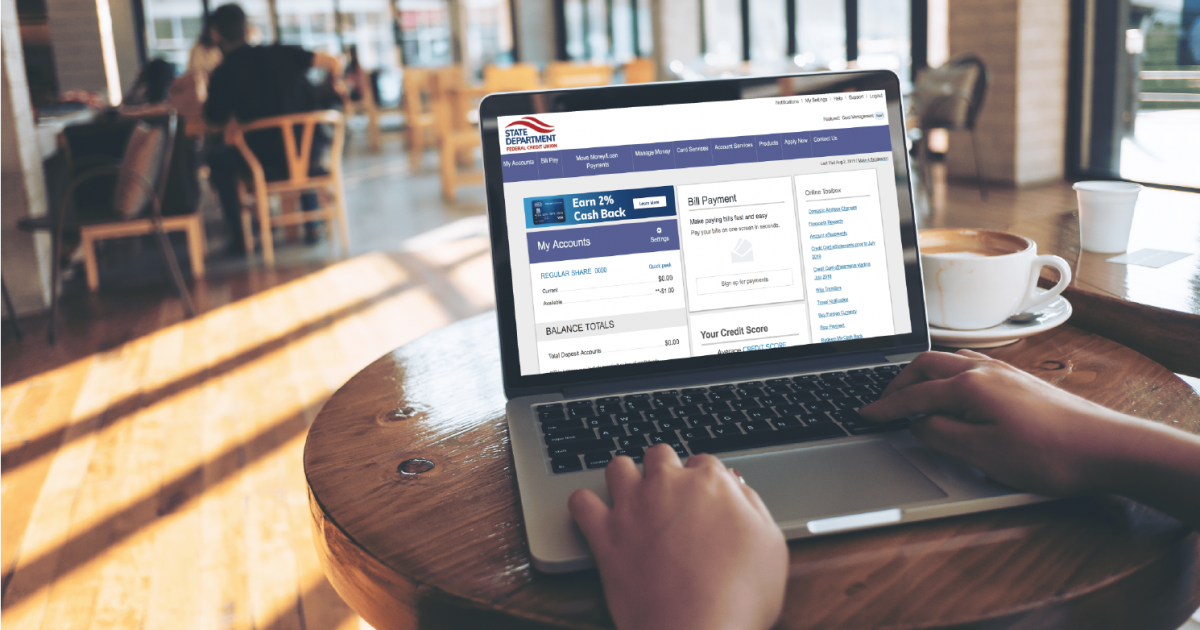

Online Banking

Sddfcu Online banking allows you to access your bank account from anywhere, with a computer or smartphone. It allows you to check your balance, transfer money and pay bills.

Online banks typically have lower fees and better interest rates than traditional banks. They can also offer 24/7 customer service.

The key to online banking is to make sure your account information is secure. That means creating a unique username and password, and never sharing them with anyone else.

Credit Cards

Sddfcu Credit cards offer a convenient way to make purchases, pay bills and help manage debt in some cases. But it’s important to use them wisely and responsibly – or you could end up with debt, interest charges and bad credit.

The best way to avoid debt is to always pay your full statement balance in full, and avoid interest charges on unpaid balances by making a minimum payment each month.

Most credit issuers charge a fee for late payments, and your payment history can affect your credit score. You may also be charged for cash advances and foreign transactions, so it’s important to read the terms of your credit card agreement carefully.

Savings Accounts

Savings accounts are a great way to stash money for short-term needs or earmark funds for a big financial goal. They offer reliable security and federal protection against bank failures from the Federal Deposit Insurance Corporation (FDIC).

To maximize interest earnings, keep your savings in a high-interest account. Some savings accounts offer a compounding effect, meaning that the more money you save, the more interest you earn.

Minimum Balance Requirements

You can find traditional savings accounts at brick-and-mortar banks and credit unions, as well as online. Depending on the type of account you choose, you may be subject to monthly fees and minimum balance requirements.

Loans

Loans are a common way to fund major purchases or investments. But they can also be a huge risk if you’re not careful.

Luckily, there are a few tips that can help you make the most of all your financial solutions and avoid any pitfalls along the way. These can include determining your goals, understanding what risks are involved in different solutions and taking the time to compare options before making any decisions.

Short-Term & Long-Term Financial Goals

The first thing you should do is determine your short-term and long-term financial goals. This will ensure that you can find the right financial solutions to help you reach them.

Investments

Investing involves the purchase of assets with the hope that they will increase in value over time. This is often done in the form of bonds, stocks or real estate.

There are many different types of investments to choose from, each requiring research and focus. The best approach is to develop a strategy and allocate your resources based on goals and preferences.

Final Words:

Investing requires some risk, but it can be a great way to grow your wealth and ensure financial security for the future. It also offers a number of tax advantages.